can i get a mortgage if i owe back taxes canada

Check Your Eligibility for Free. Not paying your taxes is a crime and has major financial and personal costs.

Pin By Jessica Hufford On Money Tax Checklist Tax Prep Checklist Tax Preparation

For 2019 this penalty is 5 of the balance owing plus 1 for every month you were late to a.

. The penalty for filing a tax return. Our Reverse Mortgage Calculator May Assist You In Better Understanding Eligibility Try It. As seen above a fully tax-deductible mortgage would occur once the last bit of principal is borrowed back and invested.

The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. Get a Free Information Kit. My borrower owes the IRS approximately 16000 for tax years 2016 and 2017.

Back taxes no mortgage until now If you. You can get a reverse. If you have current mortgages or taxes in arrears our experts can provide relief from financial burden.

When you are behind on your mortgage payments the sooner you act the better. Can you get a reverse mortgage if you owe back property taxes. Can you get a mortgage if you owe back taxes to the IRS.

Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a mortgage. If you have self-employment income you have until June 15 to file your taxes. Ad Founded in 1909 Mutual Of Omaha is a Company You can Trust.

If you owe back property taxes the taxing authority gets a lien on your house for the amount due plus any interest and penalties. The answer can depend on your particular situation. There are multiple options for how you can receive funds You can get an upfront one-time advance of the full mortgage.

We can help to arrange that. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. Also important for a self-employed borrower is.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. Basically if you let an entire filing year go by without paying the IRS what you owe its. They charge penalties and interest on all tax arrears.

Two financial institutions offer reverse mortgages in Canada. You can also take smaller amounts minimum of. Therefore it is possible to get a.

If you filed your tax return after the filing deadline CRA charges a late-filing fee. Ad 2021s Trusted Reverse Mortgage Reviews. Comparisons Trusted by 45000000.

Ad Founded in 1909 Mutual Of Omaha is a Company You can Trust. So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely. Trusted by 1000000 Visitors.

They can withhold child tax credits and GST. Robert Floris is a Mortgage Broker. Get a Free Information Kit.

So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely. His office is located at 651. All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage.

Learn the Upside Disadvantages. Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending. The debt owed is still 100000.

See How Much You Can Save. Yes we can even help you remove that pesky Revenue Canada lien if you have one. Ad View Top-Rated Refinance Companies.

Find the Lowest Mortgage Refinance Rates. The CRA has strong powers to make sure they collect what people owe. However 100 of this.

Ad Are You 62 and Have Good Credit. In short yes you can. If you are convicted of tax evasion it can also lead to court-imposed fines jail time and a criminal record.

Home equity is the difference between the value of your home and how much you owe on your mortgage. If you try to sell your house youll need to pay. HomeEquity Bank offers the Canadian Home Income Plan CHIP which is available across Canada.

Will review your application as early as 18 months 2 years after discharge if you have re-established your credit. Having tax debt also called back taxes does not preclude you from qualifying for a mortgage. For example if your home is worth 250000 and you owe 150000 on your.

The deadline for filing personal income tax returns in Canada is April 30. If youve been turned away turn to us we get mortgages approved. They have 20000 in savings but were hoping to use that money as a down payment to.

Back taxes are any taxes that you owe that remain unpaid after the year that they are due. Mortgagees are prohibited from processing an application for an FHA-insured Mortgage for Borrowers with delinquent federal non-tax debt including deficiency Judgments. In the case of CMHC while it may take some time they can also seize your tax refunds.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. In Ontario any mortgage shortfall after the sale of your home becomes an unsecured debt.

Canada Mortgage and Housing Corp.

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

2022 No Tax Return Mortgage Options Easy Approval

Holidays In Selected Countries Notice The Uk Is Relatively Low On This List Although Some Typically Produ Holiday Pay Teaching Inspiration Best Pictures Ever

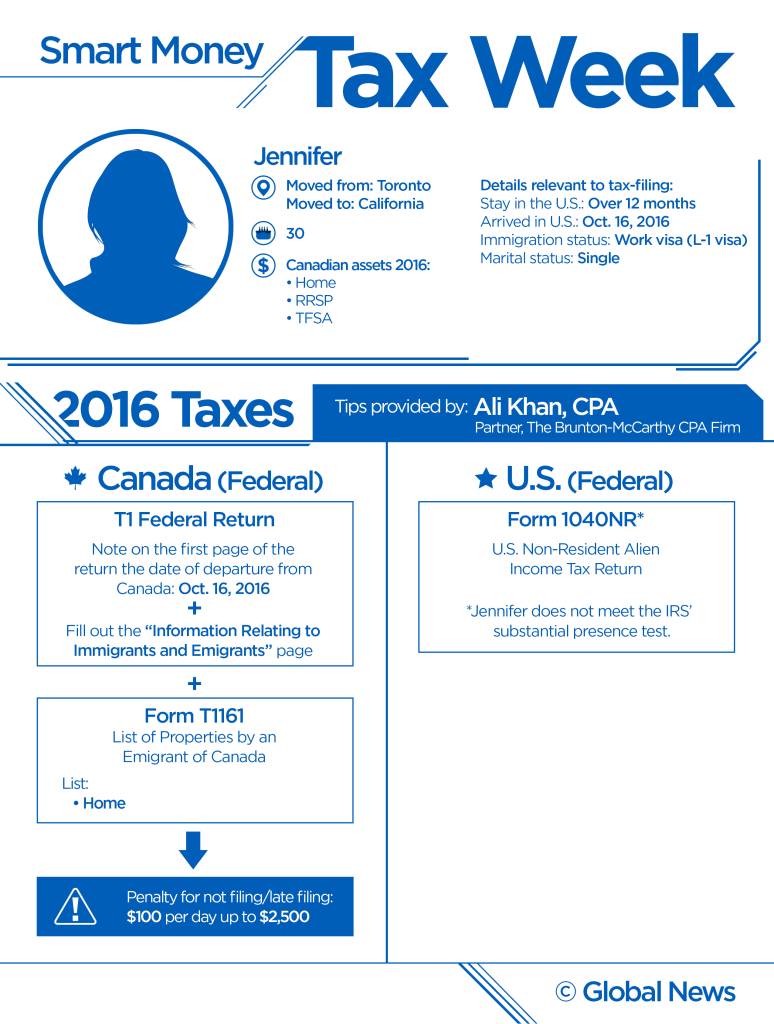

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Infographic Tax Tips 2014 Www Ativa Com Business Tax Tax Time Tax Prep

How Do Tax Liens Work In Canada Consolidated Credit Canada

Will I Be Able To Buy A House If I Owe Taxes Loans Canada

How Does A Tax Refund Work In Canada Nerdwallet Canada

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

T4 Slips What Canadian Employees Should Know Nerdwallet Canada

What Are Variable Fixed Open And Closed Mortgages Mortgage Mortgage Payoff Refinance Mortgage

5 Tax Tips For Canadian Families Callista S Ramblings Small Business Tax Deductions Business Tax Deductions Tax

When Does Mortgage Affect Your Taxes 2022 Turbotax Canada Tips

Google Trends Show Personal Finances Are A Top Priority For Canadians In 2022

How To Make Your Canadian Mortgage Interest Tax Deductible

Real Estate Market Update 5 Reasons Why You Should Buy A House Home Buying New Home Essentials Real Estate Infographic